Custom Credit is a responsive web application designed to streamline

financial management for users seeking flexible loan options. This

fintech platform allows users to apply for loans, manage repayments,

and access financial insights through a user-friendly interface.

200OK Solutions partnered with the client to deliver a secure and

efficient application that addresses the needs of modern borrowers,

showcasing fintech software development best practices and robust

data security measures.

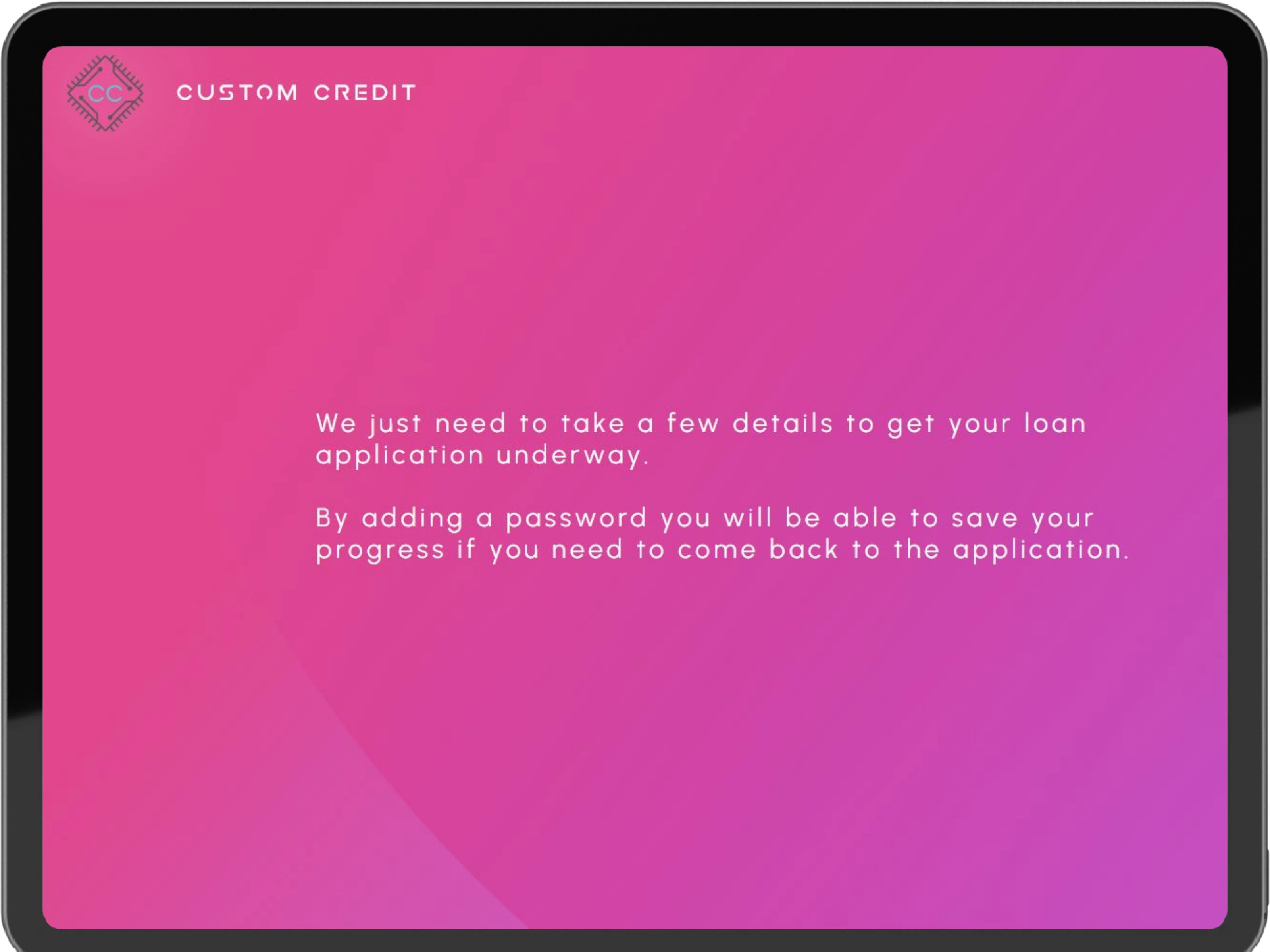

Loan Application Process

A seamless and intuitive process

for users to apply for loans with

customized terms, reducing friction in

online loan application workflows.

Customization Options

Flexible selection of loan amounts and durations

with automated interest rate calculations,

crucial for personalized borrowing experiences.

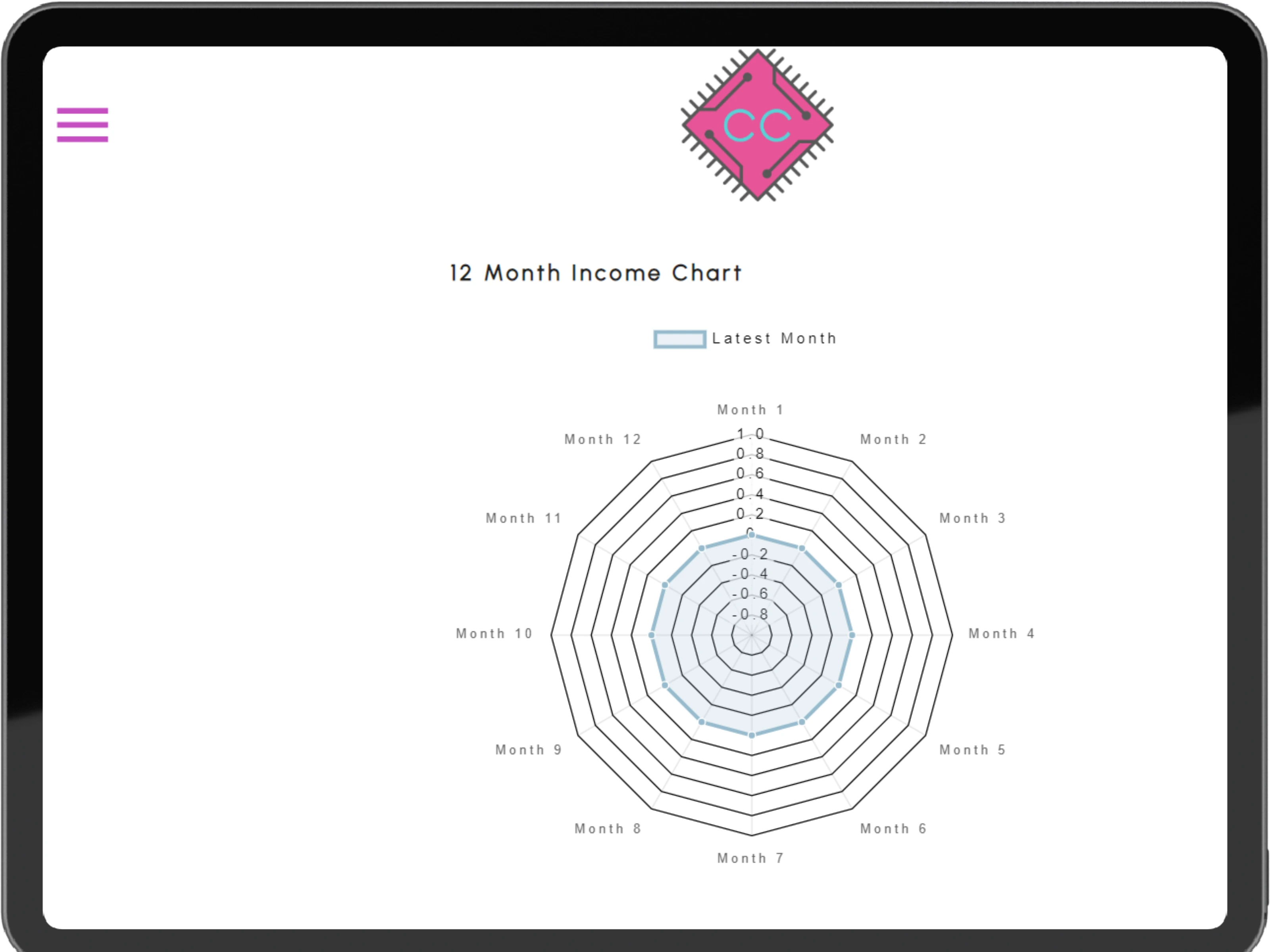

Financial Dashboard

Visual representation of spending and

repayment history through

graphs and charts, aiding financial insight and

budget planning.

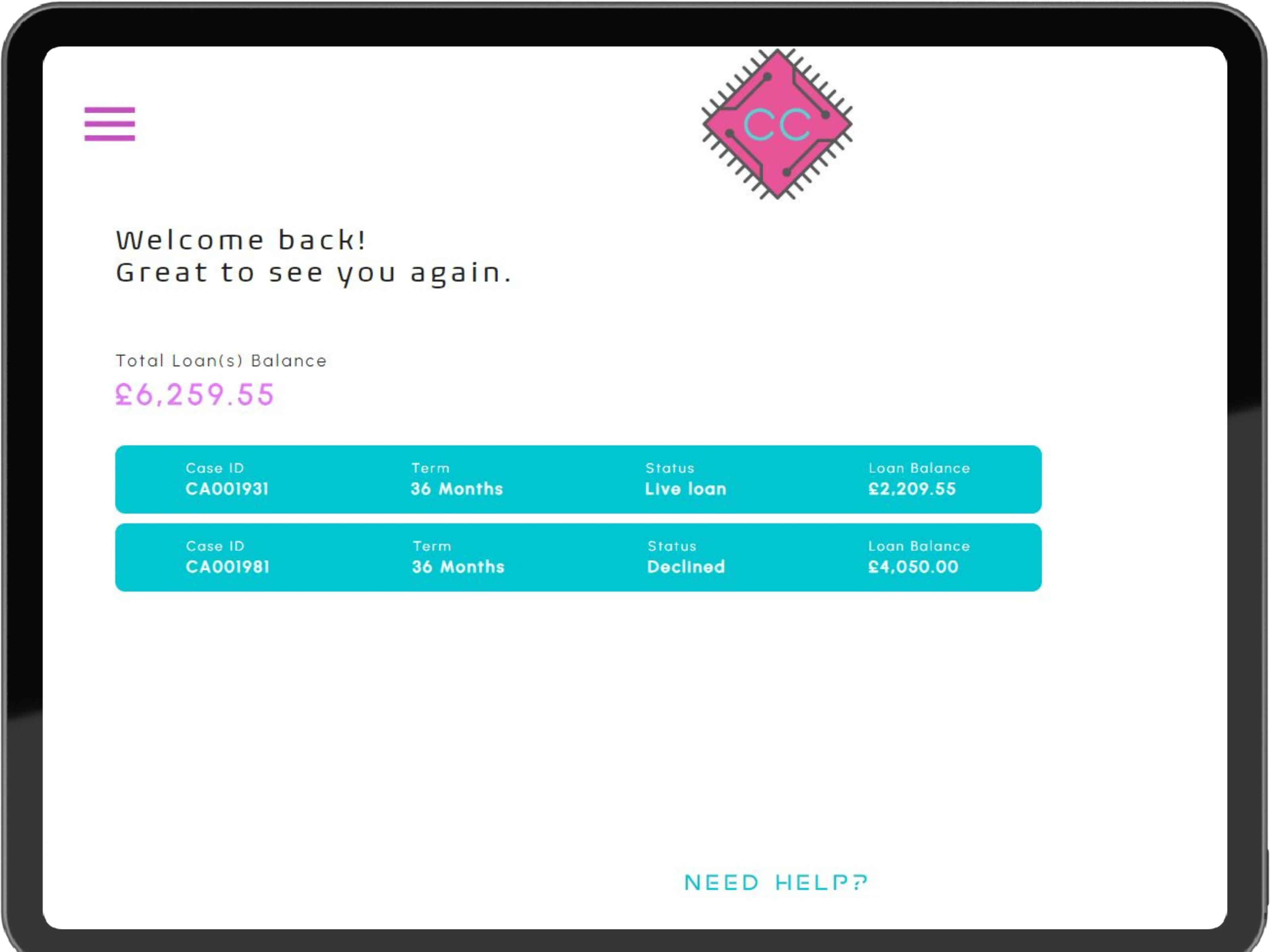

Payment Management

Options to update payment methods and review

detailed loan payment records, empowering users

to stay on top of their financial commitments.